“Don’t let criminals break your heart emotionally and break you financially.” Surrey’s Police and Crime Commissioner, Lisa Townsend, has given a romance fraud warning in the run up to Valentine’s Day this weekend.

The Commissioner has released another deepfake of herself to highlight the malicious use of video through artificial intelligence (AI) by fraudsters seeking to prey on people looking for love and companionship for their own financial gain. It’s a crime commonly known as romance fraud.

Set in a candlelit restaurant, the deepfake of ‘AI Lisa’ dressed in red explains that she is ‘machine-made’ and that fraudsters are using this type of technology to manipulate film, pictures and voices to create fake profiles and build ‘relationships’ with the intention of stealing money or personal information.

Question EVERYTHING

This new deepfake video is part of the Commissioner’s Question EVERYTHING campaign which aims to raise awareness to the perils of AI when in the hands of fraudsters. An information guide called: The Dangers of AI and deepfakes: How to avoid becoming the victim of AI generated scams is available to read here

In a bold move to launch the Question EVERYTHING campaign back in November, the Commissioner agreed for a deepfake video of herself supporting a bogus financial scheme to be made to show how easy it is for fraudsters to deceive people using AI. This original film has been viewed online by more than 30,000 users.

“Cruel crime”

Lisa said: “Romance fraud is a particularly cruel crime. Some of the most vulnerable people are targeted such as individuals who have recently been widowed or those recovering from serious illness.

“Romance fraudsters most commonly initiate contact through Facebook, Instagram, dating sites and other mainstream social media, and then move conversations off monitored platforms to private messaging services such as WhatsApp or Telegram to avoid detection.”

Total victim losses

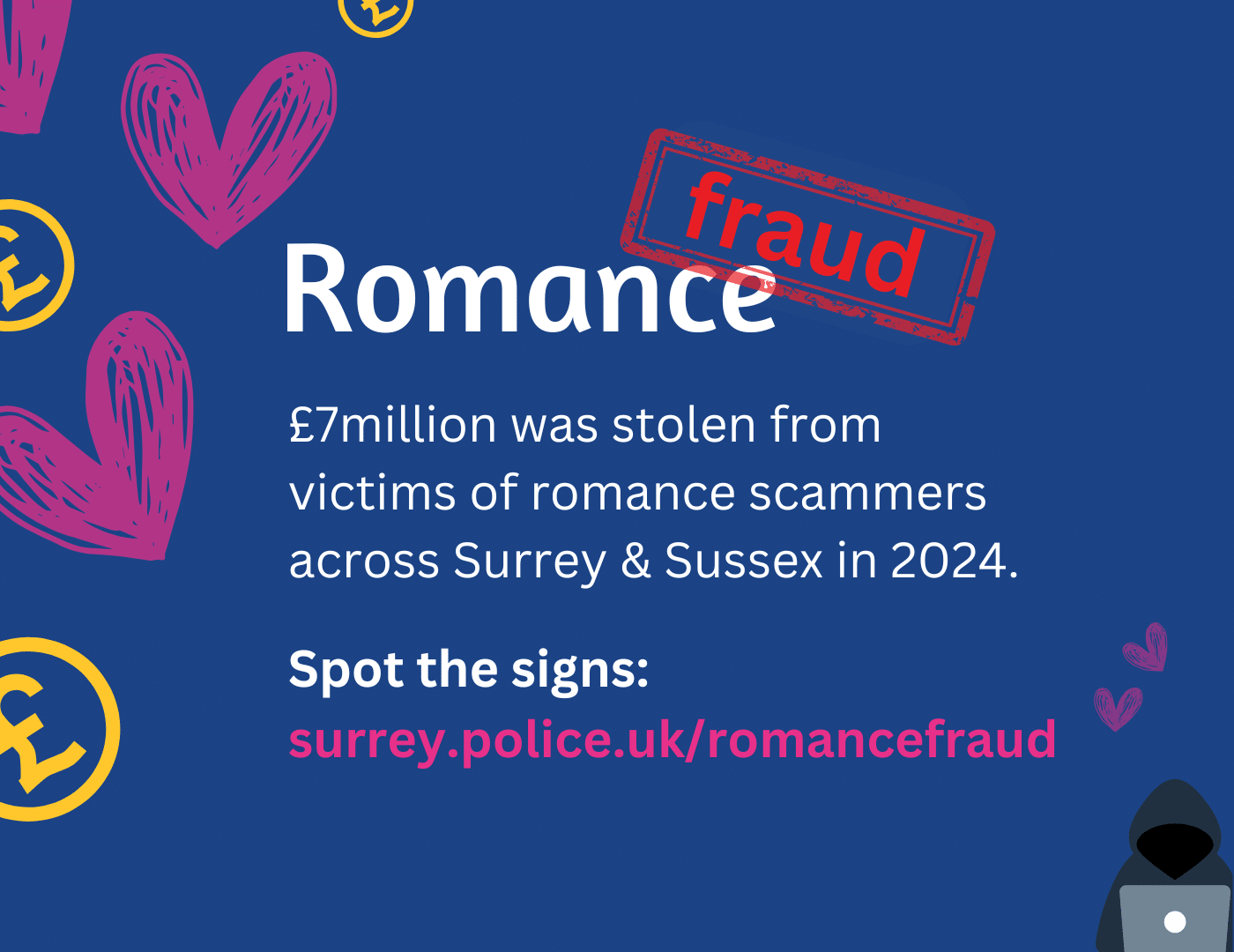

Data from Report Fraud reveals that nationally, there has been a year-on-year increase in reported romance fraud crime since 2022 with total victim losses amounting to just under £110 million in 2025 alone.

Criminals are increasingly using AI to perpetrate this type of fraud, including here in Surrey.

Financial Abuse Safeguarding Officer for Surrey Police, PC Bernadette Lawrie BEM said: “Fraudsters are able to use artificial intelligence, such as AI‑driven chatbots and deepfake technology, to produce highly convincing profiles, conversations and even fabricated videos.

“Locally and nationally, we are seeing a growing number of cases in which individuals genuinely believe they are in a relationship, or even engaged, to a well‑known public figure.

“Fraudsters are impersonating high‑profile celebrities, with some of the most commonly used names being Elon Musk, Tom Jones and Keanu Reeves.The majority of victims locally are female.”

“Devastating consequences”

Lisa adds: “Romance fraud is surging, and by using AI technology, fraudsters are able to closely mimic human behaviour, provide immediate responses, and exploit vulnerable people with devastating consequences.”

To stay safe from romance fraudsters – beware of the following warning signs:

- They try to move the relationship on too quickly

- They always have an excuse not to meet in person

- They share emotive or traumatic stories but provide little detail

- They request or provide reasons as to why the relationship should be kept secret

- They pressurise you to send them money or gifts or invest in something they’ve suggested

- They quickly get upset, frustrated or angry when you question them on details about their life

- If your instinct doesn’t feel right in an online relationship: pause, talk to someone you trust, and do due diligence checks before making any payments to them.

- Above all, never send money, share personal documents, or transfer funds to someone you’ve only met online.

DATES acronym

Surrey Police recommend the DATES acronym to the public as an easy reminder to protect themselves from romance fraudsters:

- Don’t rush into online relationships

- Analyse profiles for inconsistencies

- Talk to trusted friends and family

- Evade scammers—never send money or share financial details

- Stay on secure dating platforms

It’s not your fault if you become a victim of romance fraud. If you are worried:

- Confide in someone you trust

- Do not send any more money, personal documents or images

- Report it to Surrey Police on 101